0. disruption

We are living different and difficult times.

In an environment already precariously fighting for its survival, a virus has disrupted our habits, routines and lives at large. We now see our existence at risk. We take notice.

Could all this happen with no consequences on our lives and, ultimately, what our needs will be? Can we ignore the impact of this?

Here is our take.

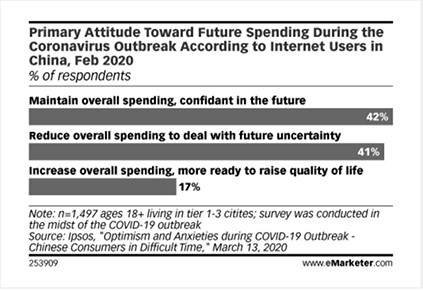

SENTIMENTS. HABITS. Already in January 2020 ‘the Conference Board’, was warning a global rise in consumer caution. “An intensification of concerns about job security and personal financial well-being, especially if combined with lingering geopolitical uncertainties,” that “may erode consumers’ confidence in the economy and cause them to rein in their spending.”

The organization later published a report in March – prior to the worsening of the situation and mass lay-offs – showing a pronounced decline in consumer sentiment in the US – where consumer spending represents about 70% of GDP.

In the same period, according to data by ‘Morning Consult’, corona virus has further worsened Japanese consumer confidence, by this time made precarious by the slow economy and the recent increase of consumption taxes. Italy consumer confidence in the same month fell to the lowest level since 2015, Hong Kong, re-emerging from a terrible 2019 – trade wars effects, protest – saw retail sales plunging by 44%. Singapore retail has reached the lowest level in 12 years.

As the crisis worsens, we stay home: cancelling our travels, working digitally, cooking our food. We are communicating via video with our families away from us. Most importantly, we spend more time alone and, freed from the busy schedules that have defined our lives, we interrogate ourselves.

As everybody feels more on his/her own – some having lost their jobs – how is our mindset changing? How is the new ‘lifestyle’ affecting us and defining a new sense of necessity, priority and community?

To start, we seem to be re-connecting with the simpler, the value of ours and family physical and mental wellness. We are looking closer at what we need and who needs us, our environment our immediate community of care.

Would the current uncertainty and a sense of personal vulnerability, coupled with supply chain issues and blue skies – an almost undeniable evidence of the incompatibility of consumption and environment – be announcing a change in priorities and shrinkage in consumption?

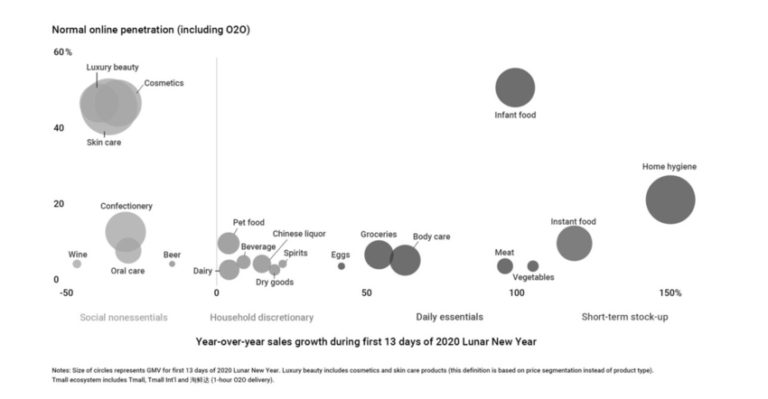

NEEDS. PRODUCTS. SERVICES. Since the beginning of the crisis, across geographies, consumers have focused on priorities.

They have not spent much in not-necessary items – apparel, shoes, or other items – with the exclusion of the occasional t-shirts, pajamas and sneaker.

In China, as in Italy and US, consumers have unsurprisingly given priority to groceries and cooking tools, medicines, home cleaning and personal care products.

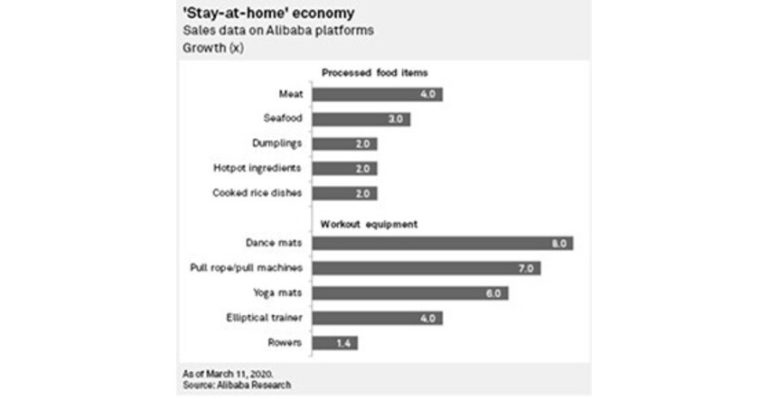

Besides take away and food delivery – varying according to geographies cultures and quarantine situations – concerned with food safety, people have decided to cook fresh meals by themselves and have invested in cooking tools.

In China, sales of eggbeaters were up by a 260% on Pingduoduo; Fenqile saw an increase of grills and kitchen appliances. In the US, according to NPD, small kitchen appliances as bread makers and electric skillets have seen a triple-digit jump, and sandwich makers, electric pasta makers, citrus juicers and rice cookers have all seen sales grow.

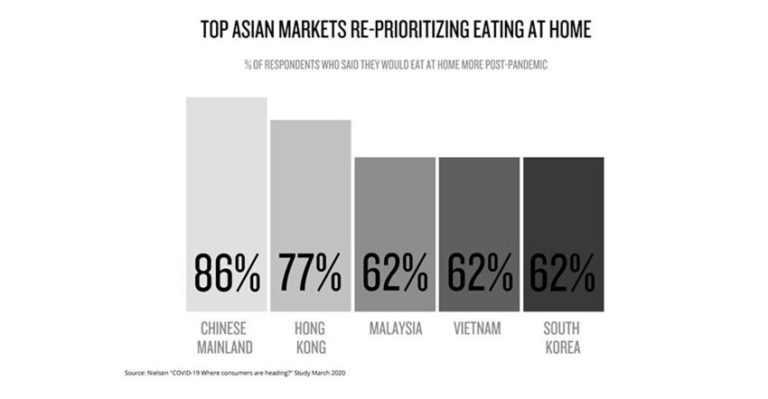

Interestingly, a study by Nielsen concerning Asian main countries, shows how consumers are planning to continue to eat at home after the pandemic, as well as pay more attention to what they eat. “Consumer thinking and actions have been reoriented, and this will have long-term consequences (…). Not only will consumers reassess where they’re eating, but they will also be far more cognizant of what they’re eating.”

Perhaps for the guilt of eating, attendances to on-line exercises and self-improvement classes have also increased.

Looking to engage their community, sports brands have been offering clients possibilities to take up classes – i.e. Nike training club – and spiritual practitioners have been helping their clients to cope with stress trough free meditation sessions.

Sales of gym accessories, dance and yoga mats pull machines and dumbbells have increased in China as well as in the US.

Spas have been offering to their client’s products and advices on how to improve our personal care.

More people have been reading and taking advantage of free access offered by newspapers and magazines – NYT, WSJ, the economist, the Atlantic, la Repubblica, etc – but also have been buying more books.

UK’s Waterstone sales looked growing by 400% week on week at mid-March.

Many of us are binge watching movies now brought online by big and small streaming companies, in a range of international and typology diversity never seen before.

We are listening to opera and exploring museums archives on streaming.

IT WOULD SEEM WE HAVE CHOSEN WELLNESS AND CULTURE. our priorities.

True: this is to be an expected pattern of behavior during a crisis.

True: we have learnt from other crisis that this may not last and sales of non-essential items take longer to recover.

True in china – now re-opening to business – there are episodes of ‘revenge shopping’ in the luxury categories and queues outside typical noodles restaurants.

Nevertheless, the numbers and visibility of deaths, the massive layoffs, the sense of precariousness are likely to have a durable impact on us.

The longer the current global situation is going to last, the more it is likely to accelerate a process of re-evaluation of our lifestyles we probably started in silence long before.

In China, place of most recent mass shopping enthusiasm and sustaining a big chunk of the business of many international companies – things may change particularly among the young.

One of the most respected Chinese influencers, Becky Li has shared how ‘my team members are mostly post-1990 and post-1995 and they all agreed that they would not be spending carelessly anymore. This outbreak has reminded everybody (…) the crucial importance of having an emergency fund’.

The sentiment is echoed by young Americans. According to a survey conducted last February among 500 millennials by First insight, an American predictive analytics company, “ behavior is changing more dramatically than any other generation” the generation who grew up in the uncertainty of 9/11 and the economic crisis is determined to cut their spending.

OMNI-CHANNEL. SPACE. COMMUNITIES. Understandably, at the moment, even those who still can don’t seem to feel like going out much…

According to a poll conducted by BCG in mid-march 79% of Italian responded said they were limiting their daily visits to physical stores vs a 49% of France, 47% of US and 32% of UK citizens who were not yet experiencing high cases.

Many of those who still have a job are likely to be working from home.

A global survey on 20,000 people in 2017 by Regus and Statista highlighted how 65% of Chinese business people were working 2.5 days remotely from home, 52.6% in the US. Although not everybody will be able to work remotely, in January 2020, the trend was registering a significant growth that is likely to continue now that companies have explored the feasibility of it.

Working or not, people staying home, after months of ‘digital training’, are likely to be more prone to order their necessities on sites; even south European countries – traditionally adverse to embrace online – have discovered some convenience in doing it.

Once everybody will become more familiar with e-commerce and trust more digital pay way, it is likely the growth of online will continue.

As noticed earlier here, however, we are believers online will not completely overtake physical commerce. Even without considering the mounting acquisition costs that forced DTC brands to debut offline, the need of human relations and the vicinity to a community is part of what we are.

Hence, new retail – the integration of digital and physical retail– will continue to grow.

If so, where would we find our community?

Since before the crisis, there seem to have been a “trend-ency’ in embracing the calm and casualness of neighborhoods. Some of the more innovative new developments have been rediscovered old patterns of living, also in the US a noticed by Elizabeth Segran “(…) brands are increasingly entering cool neighborhoods and renting storefronts next to the places where people work, eat, and seek out entertainment. “

The tangible current fear of big places – often out of stock – and the need to interact with familiar faces seem to accentuate the tendency to stay in the neighborhood, patronize local stores where owners are embracing this opportunity, laboriously taking care of a group of customers they thought they had lost.

Across Italy, neighborhood stores are going strong. In the last week of march, according to data from the National Italian Retailers association, in Padua – one of the areas most impacted – local grocery stores recorded a 50%, sales growth , green grocers sales grew by 90%. Same trend is observable in the UK.

Would this trend continue? We feel so, in various incarnations.

We are likely to see a more pronounced resurgence of the local shops. We may also assist to a ‘localization’ of the ‘generic’ retail: retail that became globalized and multiplied to a point to become irrelevant to residents and tourists alike.

This is certainly a difficult period for those small business in non-essential services and, for many, survival is sadly dubious.

However, it is also a moment of opportunity. Small operators are less layered, closer to their customers.

More agile and eager to listen to customer needs, embrace learning, recovering and adapting faster to the requirements of new business models.Just look at how small food operators have been adapting.

Farms directly delivering to customers. Restaurants and wine cellars not only quickly re-converting to take away and delivery but ‘disrupting’ the delivery business with requests of decreases or levy of commissions. The food industry is probably going to redesign deliveries’ business models altogether.

Big establishments are advantaged in standing this crisis because of their financial strength, yet they will need to make some choices. Some chains were severely suffering from obsolescence in the commercial proposition and distance from the community’s needs.

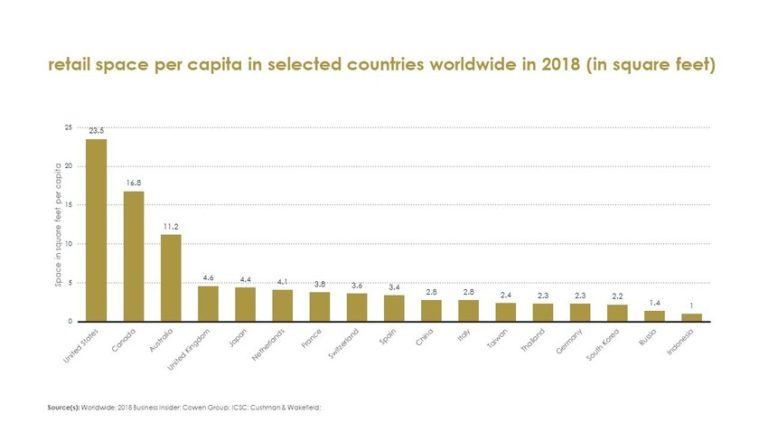

In America – a country sporting the highest square footage per capita in the world , 23.5 sqf in 2018 – according to Rodrigo Gonzales – CEO of Deodate – “hundreds of shopping centres (…) located in areas with at least 25% concentrations of Asians, African Americans and/or Latinx demographic groups ‘ have tenant mix and shops irrelevant to the current customers.

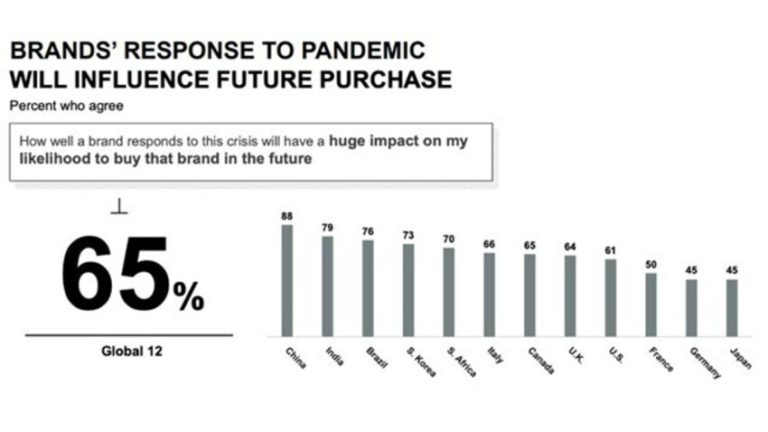

Patrons – particularly the younger generations – have taken notice of the phenomenon and already chosen other establishments more suitable to their needs as well as their values. A global poll among 12,000 people conducted by Edelman in March, emphasizes how 65% of responded said the behavior of companies and brands during the corona will affect what they will buy from them.

In China – a key retail market – 82% of respondents said they recently have started to use a new brand because of the way they responded to the corona virus.

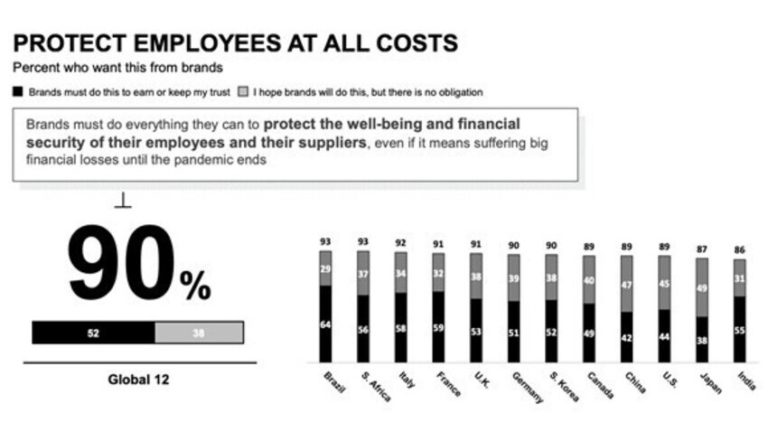

90% of global respondent said that brands should do all possible to protect their employees to maintain their trust – with a 92% of Italian respondent, 91% in the UK, and 90% in Germany and south Korea.

Thriving commercial communities are first of all communities of people: consumers as much as tenants and employees.

Those operators who can afford it, may consider the preservation of their extended community a lifesaving strategy.

It’s not hard to imagine the actions of Lululemon and Sands – regularly paying employees’ salaries during the crisis – or, among the luxury brands, Hermes and Chanel – refusing public fund integration of employees’ salaries , setting an example for bigger groups – will be remembered by clients.

Or think Hong Kong’ situation, versus the decision taken by visionary operators to offer rent free-periods to their small tenants – i.e. Detroit’s Bedrock real estate – that will guarantee the sustenance of already complex communities re-building efforts and, therefore, protect their own investmentt.

As we often remind to ourselves and our ecosystems: communities are alive, they are rooted in memories and it takes time to build and, especially, rebuild them. These are the moments when they need actual help and presence.

CONCLUSION. Even before the current pandemic – across channels – customer-facing businesses and retail have been experiencing a long crisis caused by endless competition, increasing cost of operations, global events and, most fundamentally, by self-inflicted pains rooted in predominantly financial objectives, stubborn homogeneity and deafness to customers and community needs.

There might have been an unconscious awareness of the need to reconcile with reality and adapt. There may have been an underlining understanding a radical change was indeed coming.

Still, the fascination with the idea of possible continuous expansions diluted the urgency, made a change look impossible. For all apparently logical reasons, companies have sometimes witnessed to shifts in customers behaviors without necessarily considering the need to integrate them within their strategies.

As result – across developed markets – progressively dissatisfied consumers distanced themselves from much of the businesses, searching for new propositions or not buying at all. The crisis of retail and commerce probably started there, from a lack of meaning in the offer, a lack of familiarity in the delivery.

The current forced isolation, the consequent self-re-valuation, are likely to result into an acceleration of process of emancipation of the customers.

Locked down in private spaces, we are reclaiming unconscious independence and perhaps getting used to feel comfortable with fewer and simpler pleasures – apparently embracing a de-facto de-growth.

This pandemic is working as a sort of ‘post traumatic -growth’ agent.

We are swiftly becoming different people.

At the moment, it feels like an easier transformation, not so impossible, nor a deprivation neither. “All the goals have shifted. No longer is it necessary, nor expected of us, to have visited the latest exhibition or eaten at that new restaurant or watched the most illuminating show. We no longer have to prove ourselves. (…) The great performative exercise of existing is now insignificant” – in the worlds of the FT’s Jo Ellison.

Is it only temporary?

Nobody knows what is going to happen in a post covid-19 age.

In spite of that, treasuring what we have been experiencing , we may perhaps have an opportunity to re-assess and reshape commerce making it more efficient and equipped to serve a – possibly more liberated – clientele in need of meaningful products and services, within environmentally friendly spaces animated by extended stakeholders communities

In any case, we must not fool ourselves we are entering a negotiation: more than before we are looking to a constumer-centric future. It’s up to us to recognize to take the opportunity.

published on linkedin, april 9th 2020